A recent Statistic Canada study compares the wealth holdings of family units covered by workplace pension plans – 61% of the Canadian population – with those of other families without pensions. It focuses on families and unattached individuals who had no significant business equity and whose major income recipient was aged 30 to 54 and employed as a paid worker.

This study compares wealth differences between families with registered pension plan (RPP) assets and other families. Key sociodemographic differences between the two populations are taken into account.

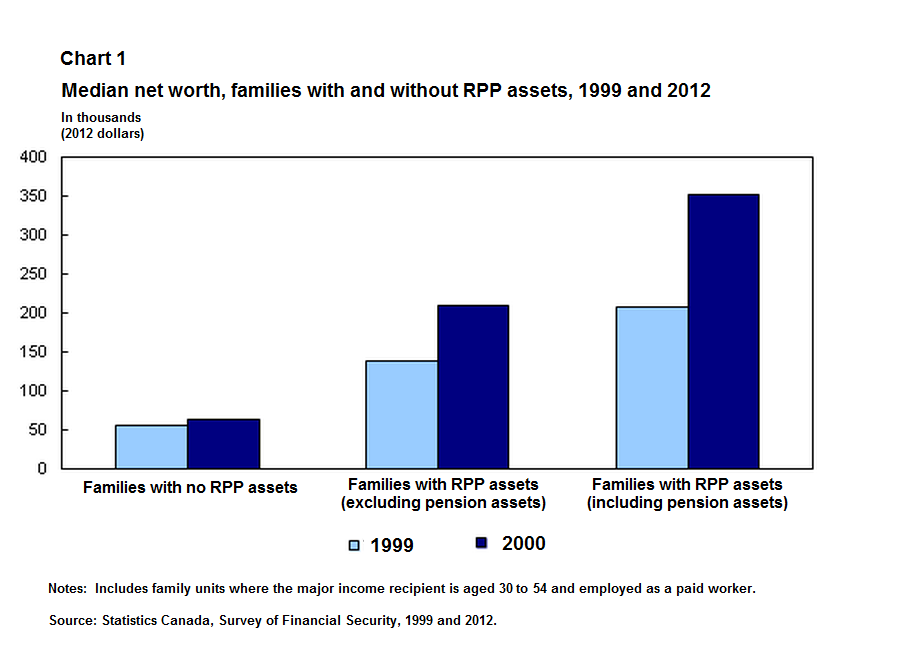

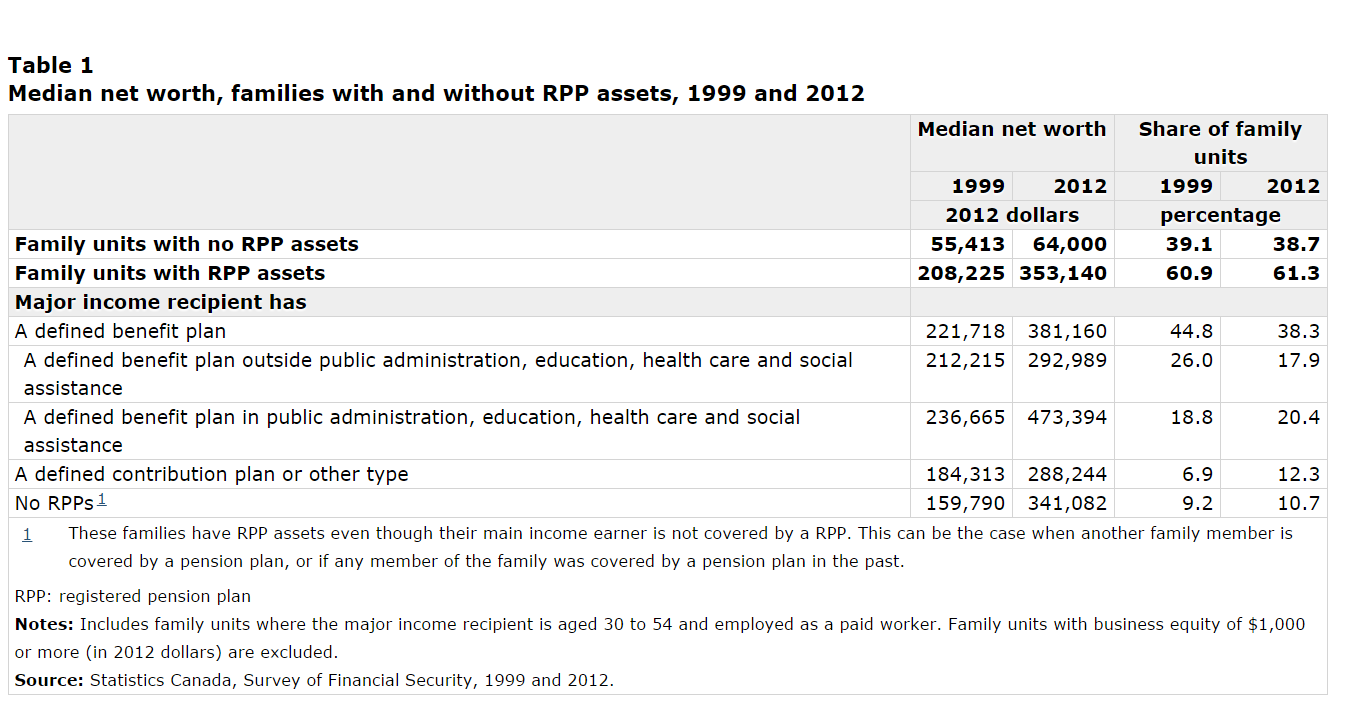

• Excluding pension assets, family units with (Registered Pension Plan) RPP assets had a median net worth of $210,600 in 2012. This median income rose to roughly $350,000 when you add in the RPP value. This compared with a median net worth of $64,000 among family units without RPP assets.

• Family units with RPP assets were more likely than others to have characteristics that are conducive to wealth accumulation, such as higher incomes, higher levels of educational attainment and longer job tenure, among others.

• In 2012, families with RPP assets were more likely to hold other types of assets than families with no RPP assets, including real estate equity (82% versus 56%), investments or RRSPs/LIRAs (79% versus 55%), or vehicles (91% versus 76%).

Source: Statistics Canada

What does this mean for Canadian investors?

When you look at the numbers it is pretty clear that those with registered pension plans (RPPs) have a much better potential of deriving a sustainable retirement income than do those without one. These stats do not even include the wealth of combined household pensions which would be the case for example if a teacher with a pension is married to a nurse with a pension.

Those with pensions deriving from employment in public administration, education, health care and social assistance, most being government jobs! — make up the highest source of pensions held, running at 34% of all RPPs, most of the annuitants being over age 40 making up the primary age group. Note: The term “annuitant” means one that receives or is qualified to receive an annuity.

The small amount of retirement savings reflected in the net worth figures of those without RPPS, indicate the serious need for individuals to invest regularly and assertively in RRSPs and TFSAs using a good financial plan.

Source: Statistics Canada