Affecting both risk and return, asset allocation is the procedure of apportioning investments among various categories of investment fund assets to design the most advantageous counterbalance of risk versus reward.

The objective is to reduce risk while maximising the gains of the unit holders. To simplify: a diversified investment portfolio invests in different companies, investment vehicles, industries and countries. Asset allocation strategies consider the following:

Know your risk tolerance. To limit anxiety, consider your investments regarding your tolerance for volatility. Any possible variation of assets can be set up in a targeted asset allocation solution in accord with your risk tolerance. The perfect asset allocation is different from person to person based on prudent, moderate, or aggressive objectives and how comfortable the client is with select investments. We assess this through a questionnaire or an investor profile.

Limit market correlation. The most important consideration is that the assets do not correlate too closely among other assets within one market.

Diversify among your investments. Designed diversification models assess your age, time left before you need to use your capital, how much you’ve already saved, and your stomach for risk. In most cases, a manager makes investment decisions for you. The purchase and sale of the investment fund’s assets are strategized and made according to their analysis of the upcoming market trends.

You can diversify among funds focusing on growth, large-cap and small-cap equity; cash equivalents, and bonds; including domestic and foreign markets among their various sectors. If you lack investment diversity, you may invest all your eggs in one basket.

Periodically rebalance your portfolio. The key is staying balanced in the same asset allocation ratios. By “rebalancing” investment percentages you maintain your initial apportioned diversity. Review your predetermined allocation ratio-goals over specific time periods such as annually. Some asset allocation systems, such as offered by fund companies, will automatically rebalance the ratios to model select allocated percentages. The aim is to help reduce your portfolio’s volatility while periodically resetting the same percentages of holdings in your portfolio in each asset category at the desired or new ratios.

Managed investments. The key benefit to asset allocation (as with all investment funds) is that credentialed, professional fund managers make the decisions for you. Your financial advisor can answer your questions and help you determine if an asset allocation fund is right for you.

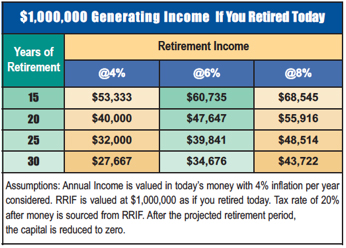

Aim for your retirement goals. Though we cannot guarantee returns on the performance of investments, asset allocation seeks to balance investment risk with future rewards, to provide the best possible income security for retirement which can last for up to 30 or more years.