If you own a business or a partnership, which has a buy-sell agreement with partner-beneficiaries, this portion of the estate needs a trusted executor who is privy to your business. Consider a business attorney or partner to assure that your part of your business estate executes well and addresses your partners’ concerns.

You may want to have someone from your family to act together with a business-related executor about your business assets. With two or three executors, consider a clause in your Will that allows a majority, rather than a unanimous vote for making decisions to avoid deadlock.

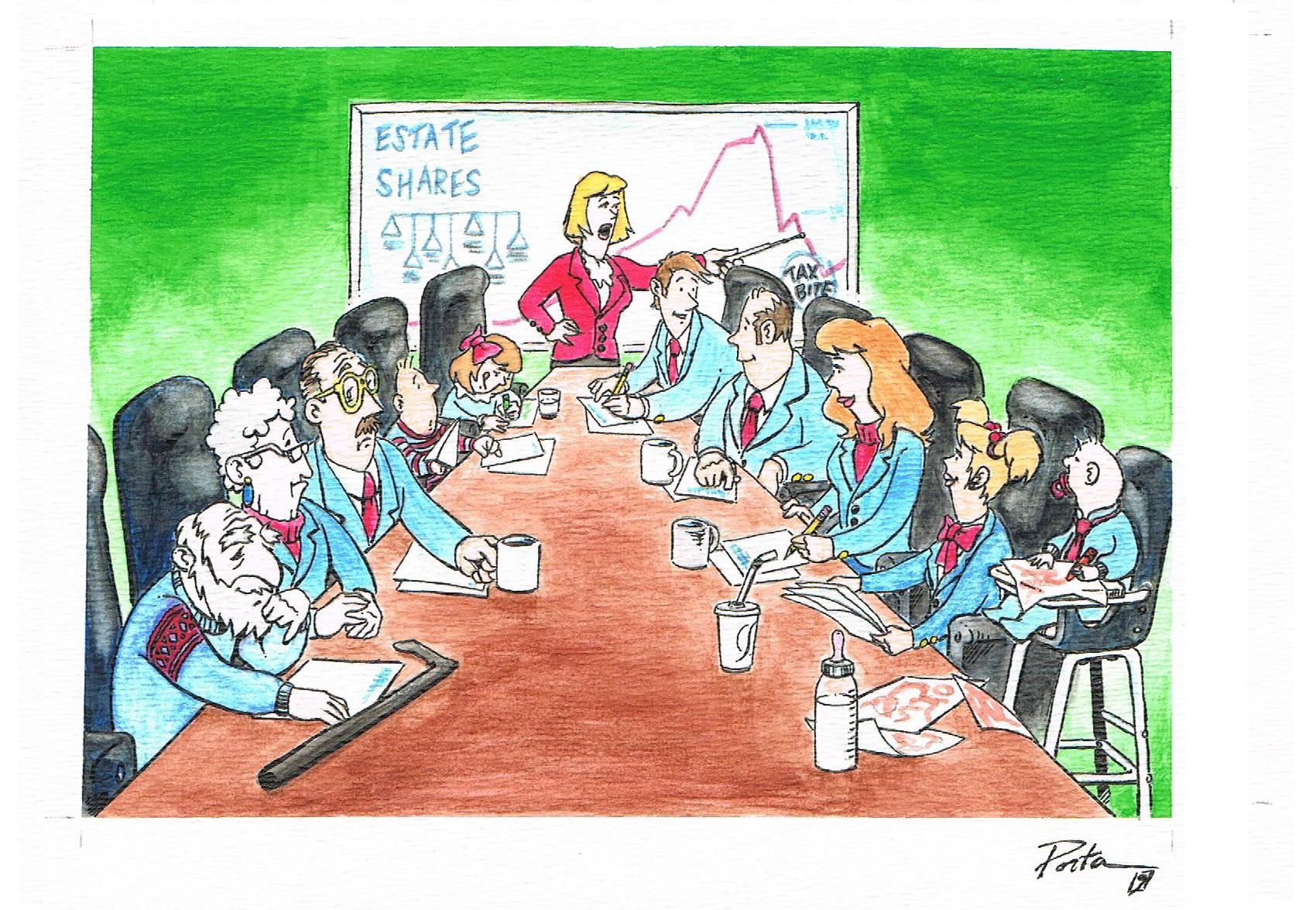

Though more than one executor is appointed, not all need to act in the case where one deems to step aside. Your Will can state that there needs to be regular communication between the executors and the beneficiaries (who may be the same people). Without transparent communication, and clarity of honest accounting, mistrust can develop between the parties.

Executors also can have their powers reserved for them rather than agree or refuse to act. If a dispute arises among executors, the probate court, which can appoint or remove an executor, determines the outcome.