To know the state of your fiscal health, you must have a personal financial health check up. Your financial advisor will help put perspective on your diagnosis and how in shape you are for retirement.

Strategies can be designed to form a comprehensive plan to enhance your net worth as you move towards financial independence, secure in the knowledge that a retirement can become a reality secure with sufficient income.

Your annual net worth statement is the benchmark measure of your ability to become financially independent. Net worth means the same as net assets – the assets you have left after you subtract your debts.

Why do this annually? Time waits for no one. Retirement approaches faster than most people admit. Consider how quickly the last five years have passed. Double this time back ten years to the 2008 financial crisis which woke the whole world to the need for financial guidance.

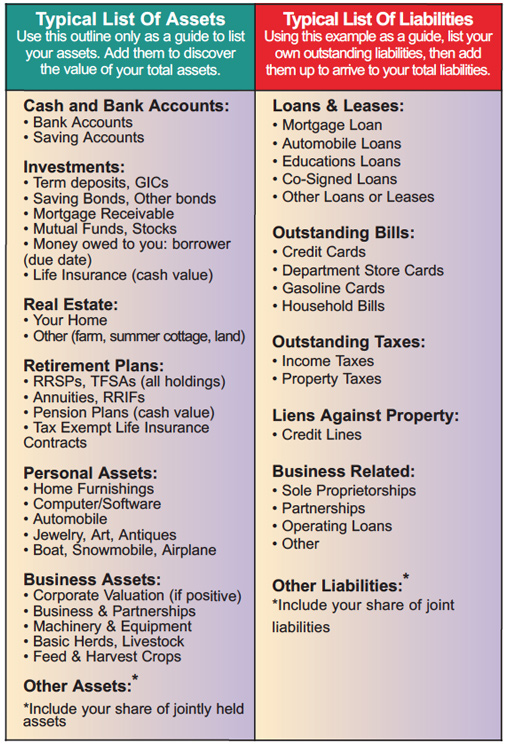

How can I know my net worth? Simply add up your liabilities compared to your assets. Subtract your total liabilities from your total assets to give you your net worth.

You gain awareness of your debts. Debt totals warn against spending beyond our means. Compound interest on a growing credit card debt at 18 to 28% can strain your cash flow. Always set goals to reduce debt.

Investment planning results become evident. Your net worth statement reveals all of your accumulated assets, including your RRSP, TFSA, and non-registered investments, putting them all into perspective. You may find that you need to rebalance your investments. You will also see which are performing well, suited to portfolio growth. While employed, this gives you a retirement metric concerning your future income goals to help you see how close you are getting each year.

It reveals opportunities for further financial solutions. Picture each financial need in contrast to your net worth snapshot. What have you saved for each future goal? Where has your income been going? Do you have home equity built up or do you still have a large mortgage? Is a Home Equity Line of Credit (HELOC) eating away at your assets? It can reveal the importance of keeping your credit cards paid monthly.

Estate & Tax Planning can affect your final net worth. To draft a will, you need to know your ultimate potential net worth inclusive of business assets. Identify capital gains tax liabilities or tax on a vacation property. Your registered monies (RRSP/RRIF) will be fully taxed after the death of the second spouse (in most cases). Assess the final estate tax liabilities on your assets now. We can assess potential tax strategies to project estate related tax debts.

Business planning can be enhanced. Succession planning simplifies the transfer of a family’s business assets to the next generation. Often a simple planning manoeuvre can ease the effect of capital gains tax or provide for a future buy-sell agreement upon the death of the principal business owner.