Many believe that a million dollars is a large nest egg and is much more than anyone will need to retire on. However, this will depend on many factors such as your life expectancy; or the longest life expectancy of two life partners; inflation rates; and rates of return on your investments.

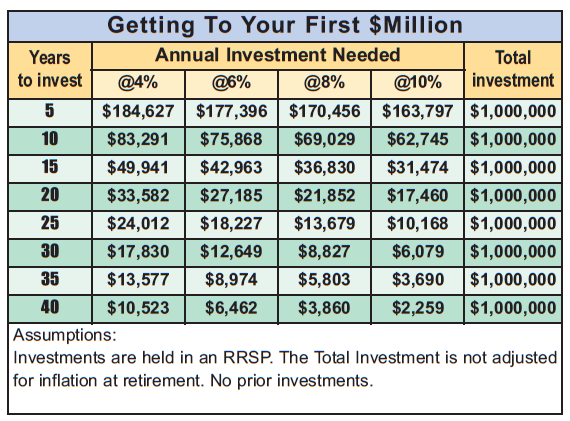

Saving the million dollars takes more initial capital or more time. Suppose you have 15 years left to retirement, how could you save $1 million for retirement? If you have invested very little to date, that goal may be impractical.

Will you be able to fund your retirement?

Canadians are facing a looming financial independence crisis that will impoverish a very large retired demographic. Consider the man who has invested since his mid-20s and now has an accumulated investment of $500,000, at age 50. He wants to retire at age 65 in 15 years. If he contributes $2,000 at the beginning of each month to his RRSP at 2.5% compounded annually, he may reach a goal of a total $1,051,278 in 15 years.

If you are close to retirement, conventional financial wisdom tells you that you should put more money into bond funds and dividend funds, which are considered safer than equity stocks or funds. However, current low-interest rates may reduce your portfolio, for some spoiling the vision of a rich lifestyle in retirement.

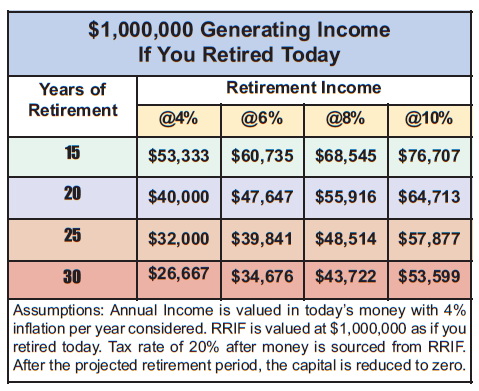

A typical 65-year-old couple with $1 million in an RRSP wants to retire. But under current conditions, if they earn 4% on their RRIF portfolio, adjusted for 4% inflation, there is a probability that they will entirely withdraw their conservative portfolio before they die.

Of course one of the biggest questions on our minds today is: “when will interest rates rise?” Several rounds of monetary policy intervention by the Federal Reserve in the USA and other central banks around the world have helped activate the world’s economies after the 2008 financial crisis. The fiscal stimulus has held interest rates and bond rates down, offering cheaper mortgages and credit card rates, which is great for consumers.

However, retirement savings with low-interest rates have presented this generation of retirees with a predicament. Many are living well into their mid-80s and 90s. If you are only invested in bonds or bond funds earning 4% for example, your portfolio may not offer an average income. If you are 65 and live to age 95, in the case of a $1 million capitalized retirement savings plan, $26,667 per year or $2,222 per month is all the money one would be able to take out of their RRIF, less the income tax payable. If the earnings go below 4%, the numbers shrink further.

Source: Adviceon

Focus on your investment plan.

One way that may alleviate this problem is to increase the equity investments in a portfolio. This would offer the potential of higher rates of return, but it would also increase the volatility and risk of the investments—a catch 22. The truth is that most people nearing retirement have under-saved and will have a difficult time maintaining their standard of living in retirement. It may be that you need to work longer to improve your financial prospects. By working longer and delaying taking your additional CPP benefits, you will be able to preserve your savings. Your advisor should be able to help present some retirement income planning scenarios for you, thus providing you with the financial considerations.