Have you ever considered the actual rate of return of an insurance policy? If you do the math and calculate the potential rate of return that can be received tax-free on Term to 100 life insurance policies, you quickly learn that developing a death benefit for your estate can be an effective estate planning tool. To further this illustration, take John, for example, a healthy 60-year-old male (non-smoker) who purchased a $500,000 life insurance policy.

John owns a business and investments that will sustain a tax liability upon his death of about $500,000. He wanted to purchase life insurance but was unsure if he should simply invest the money or pay insurance premiums. To make his decision, John would have to pay a premium of approximately $10,000 each year for his life insurance. If John is expected to live to age 85, then he would have to pay a premium for approximately 20 years, which would equal $200,000.

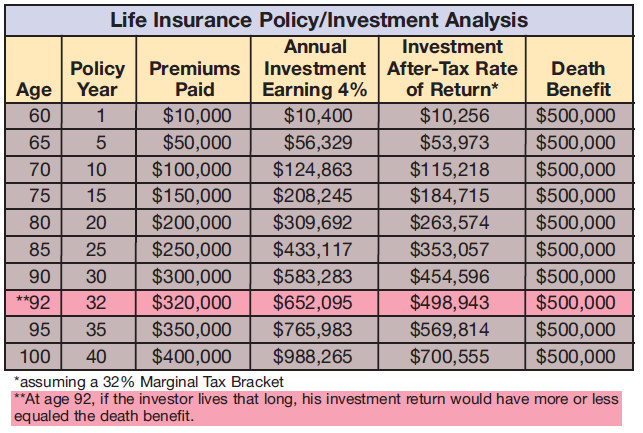

If John invested the $10,000 each year in fixed income GICs and earned 4%, at the end of 20 years, he would have $309,000 (assuming no tax on accrued interest during the 20 years). If he were to consider the effect of annual taxes on his interest, he would then have $263,574 (assuming a 36% Marginal Tax Rate). One major advantage to the life insurance proceeds is that they are tax-free! 1

When John then considers the net effect of paying insurance premiums or investing the money, he realises that the net after-tax return on his life insurance policy is 7.37%. When he compares this to the net after-tax return of 2.56% on his fixed income investment, the answer is simple! His estate, and heirs, will benefit much more if he were to purchase a life insurance policy. The only question that John still has is what if he lives longer than 20 years? Using the chart below, John can compare the net cost at various ages.

In conclusion, John’s decision is based on his goals and objectives regarding estate planning. If John lives past age 92, he would have been better off making an investment.

Considering though those actuarial statistics indicate that a current 60-year-old male will only live to age 79 (Canada), John may want to consider the life insurance scenario. That would maximise the estate benefit and minimise taxation in his year of passing, as the life insurance policy would provide maximum benefit for pennies on the dollar!

From an estate planning perspective, the risk of early death is mitigated. His estate would be paid the entire guaranteed $500,000 even if he were to die one day after buying the policy.

Notes. A comparative study needs to be done in each case as life insurance premiums can change and do vary from company to company depending on the health and age of the client. Thus the policy studied is not mentioned. Tax-free status can change depending on legislation and method of premium payment.

Graph: AdviceonMedia