You may be making your own or employee sponsored contributions to your RRSP. If you increase your contributions by just 3% per annum, you can increase your accumulation over 30 years!

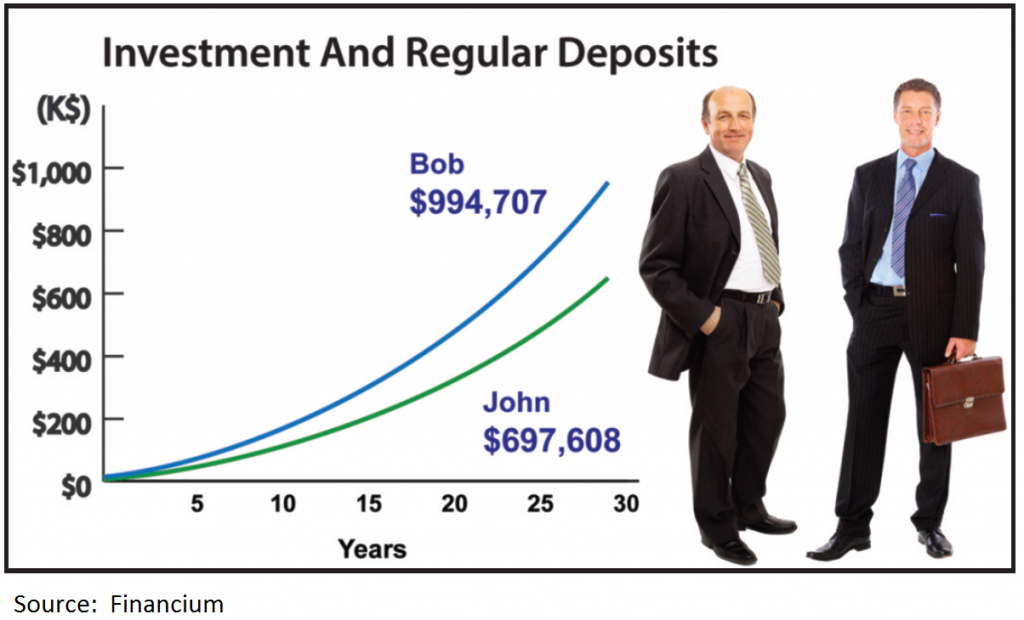

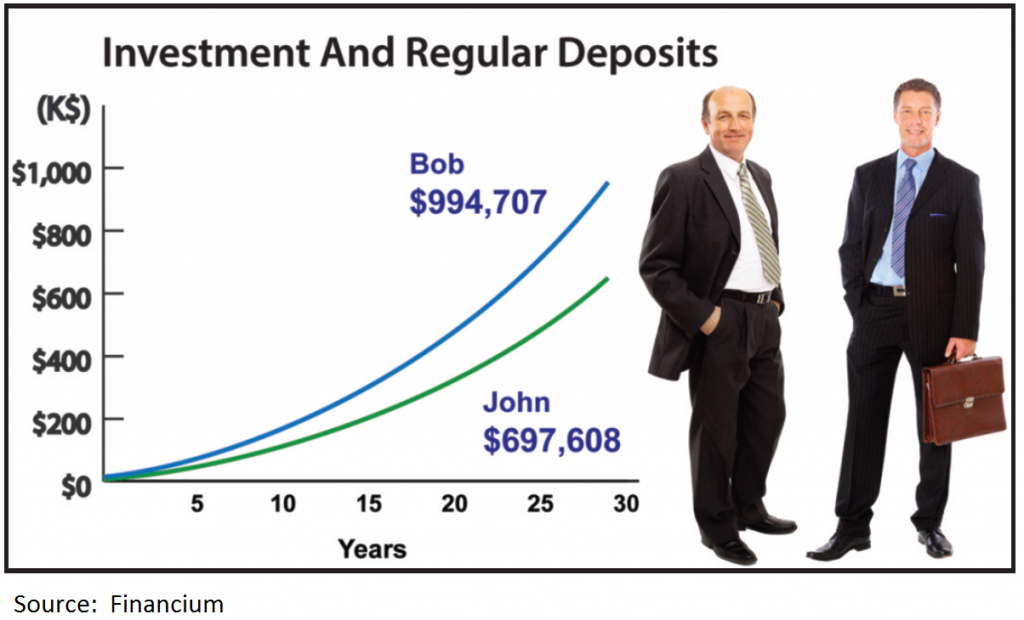

Consider doing these small changes to increase your retirement nest egg over 30 years. Look at how Bob increased his annual $10,000 RRSP investments by 3% over this period while earning an average of 5% per annum.

Compare this to John’s annual deposits of $10,000 with the same 5% average annual gain, with deposits totalling $300,000, and growth of $397,608 after 30 years, growing to $697,608. The increase of contributing 3% per annum, delivers $297,099 more accumulation in the RRSP.