Category Archives: Uncategorized

Investor Insight

Develop an investment strategy

Before you begin investing, it is important to develop a plan. Patience eliminates a desire for get-rich-quick profits. No one gets rich overnight after purchasing mutual funds. However, many people will get rich investing in them over the long term …

Read Article

Creating Wealth with Life Insurance

Life insurance provides a tax-free death benefit and is a necessary component of most financial plans. Let’s look at the Top Insights on using life insurance to protect our assets and build wealth. Types Of Life Insurance Term Insurance: Term …

Read ArticleMortgages

How to prepare to qualify for a mortgage.

When you apply for a mortgage, there are several questions that a lender may ask.

Read Article

Personal Tax Checklist

Canadian Individual Tax Checklist This checklist is for organizational purposes only and should not be considered legal or professional tax advice. Always consult with a qualified Canadian tax professional (e.g., a CPA) to ensure you meet all your specific tax …

Read Article

Business Tax Checklist

Canadian Business Tax Checklist (T2 / Self-Employed) The checklist for businesses depends on the entity type (Sole Proprietor, Partnership, or Corporation) and its fiscal year-end (FYE). 1. Key Deadlines & General Review Entity Type Tax Payment Due T2/T1 Filing Deadline …

Read ArticleFinancial Viewpoint

Avoid the dangers of Market Presentism.

We have lived through a remarkable bull market in 2025. However, long-standing investor wisdom has proven repeatedly that “what goes down must come back up.” Our goal is to manage your money through all market contingencies. That means both 1) …

Read ArticleEstate View

Life insurance insures large tax liabilities in the final return

As the population ages, more people will face tax liabilities in their estate. Planning ahead is the only key to lessen the impact on your heirs. Capital gains taxation due in the final tax return can amount to thousands and often millions of dollars. We will look at the sources of these liabilities and then look at the solutions.

Read ArticleInvestor Insight

To every life season, plan for change

We will help you plan your financial needs throughout your lifetime. Your most valuable asset is your healthy ability to earn an income. By helping you select the right combination of life and disability insurance protection and wise investments, we …

Read Article

Considerations when designing an Estate Plan

Estate planning is a process that allows one to determine how their assets will be distributed upon death. As we prepare to pass our lifetime assets to our heirs, there are key components of an estate plan that should be given careful consideration.

Read ArticleMortgages

How paying down your mortgage increases your net worth

Paying off your mortgage means that you will own your home. It moves you closer to financial independence, freeing up more money to invest for a secure retirement. By shortening your mortgage payment period, you pay much less interest over …

Read ArticleFinancial Viewpoint

Investment planning with your fiscal partner

When establishing a financial strategy involving other stakeholders, such as paying down a mortgage, develop a written plan that all parties agree on. You can create written point-form agreements for each to sign in areas of investing, registered vehicle planning, debt repayment, etc.

Read Article

Living Will: Advanced Medical Directive

The Living Will (or Advance Medical Directive) is a document in which you state your wishes regarding the continuance or refusal of extreme medical care, or just how much life support intervention you want prior to death as you age or if you become seriously ill.

Read ArticleFinancial Viewpoint

The Fundamentals of Financial Independence

Here are some essential strategies that will help you achieve financial independence. It is important to get solid advice to design a plan incorporating planning values such as those noted herein. Separate your savings from your investments. Before investing for …

Read Article

The Advantage of Using a Mortgage Broker

Mortgage brokers are valuable mediators in the Canadian mortgage market, offering distinct advantages for both new homebuyers and those undergoing mortgage renewal. Multiple Lender Access: Mortgage brokers work with numerous lenders, such as major banks, credit unions, mortgage finance companies, …

Read Article

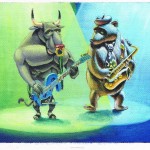

Understanding Market Cycles: A Guide to Bull and Bear Markets

Stock market language refers to two predominant patterns: “bulls” and “bears.” These terms describe the prevailing market trend and can sometimes cause concern, but understanding their meaning is key to maintaining a long-term perspective. My goal is to help you …

Read Article

Estate Tax: Planning Wisely

Tax Planning is Legal: Canadians can legally arrange finances to minimize income tax. Tax Issues to consider: RRIF Withdrawals: Increases your tax burden and may result in an Old Age Security (OAS) clawback. Provincial Tax Rate: Living in a high-tax-rate …

Read Article

FRAUD UPDATE: AI Assisted Cybercrime and Financial Fraud.

Generative AI has fundamentally changed cybercrime. It is no longer just about technical exploits but has shifted to hyper-personalized, scalable, and psychologically manipulative fraud. The scale of financial losses is unprecedented. The 2024 Internet Crime Report from the FBI documented …

Read ArticleInvestor Insight

What are the main benefits of investing in mutual funds?

The average investor, who buys stocks and bonds, does not have the necessary time to assess securities nor the expertise to make qualified investment decisions. Mutual funds allow the investor to effectively hire a fund manager to make these decisions.

Read ArticleEstate View

Updating your estate plan

What is estate planning? The nature and extent of an owner’s rights concerning land, property, and financial assets and life insurance benefits can be given over to heirs using documents referred to as the last will and testament, drawn up …

Read ArticleInvestor Insight

8 reasons to invest in Segregated Funds

There are many reasons that make investing in segregated (seg) funds a significant strategy when creating wealth.

Read ArticleInvestor Insight

Investing with a team of asset managers

If you are an investor who remembers the mortgage debt crisis of 2008-9, you know that the stock market lost significant value. From an investment standpoint, the real downside occurred when some investors sold off their equity holdings due to …

Read ArticleRegistered Investments

Understanding transferring RRSPs to RRIFs.

RRSP Maturity Strategies: You are allowed to contribute to your RRSP up until December 31 of the year that you turn 71, at which point your RRSP must be closed. Instead, you can select any or a combination of: transferring …

Read ArticleEstate View

RRSP and TFSA Rollover to a Surviving Spouse

Upon the death of a spouse in Canada, specific rules govern the transfer of Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) to the surviving spouse. These “rollover” provisions are designed to allow for the tax-deferred or tax-free …

Read ArticleLife View

Can life insurance fund RRSP estate tax erosion?

When planning your estate. It is important to consider how taxation will affect the future distribution of your estate. For individuals who are married, when the first spouse passes away, the assets can generally be rolled over tax-free to the …

Read ArticleInvestor Insight

Avoid the Old Age Security (OAS) Clawback

The Old Age Security (OAS) clawback, officially known as the OAS recovery tax, reduces the amount of OAS pension you receive if your income exceeds a certain threshold. To avoid or minimize the OAS (Old Age Security) clawback in 2025, …

Read ArticleLife View

Life Insurance and the Principle of Decreasing Responsibility

The “principle of decreasing responsibility” is a financial planning concept that states that an individual who has dependents such as a spouse and/or children has financial responsibilities that life insurance can help meet in the event of death.

Read ArticleEstate View

Understanding beneficiary designations in Canada

Understanding beneficiary designations in Canada is a critical aspect of estate planning, often overriding provisions made in a will. This is because certain assets, by their very nature, allow for direct beneficiary designations that operate outside of the estate and …

Read Article

RRSP and TFSA REVIEW 2026

Updated for 2026 What are some differences between a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP)? The tax benefits of the Tax-Free Savings Account (TFSA) The TFSA is a registered savings account that allows Canadian taxpayers …

Read ArticleMortgages

Why use a Mortgage Broker

As a dedicated mortgage professional, I have access to numerous lending institutions offering unique mortgage products. First-time homebuyers or those either with a mortgage for renewal or looking to refinance, give us a call. You needn’t look any farther as we offer great options as a one-stop broker.

Read ArticleMortgages

Reviewing your mortgage is important

We have been blessed with low-interest rates affecting lower mortgage rates. Have you thought about what happens to mortgage rates and how a household’s expenses go up when these rates rise?

Read ArticleEstate View

7 ways life insurance protects your financial foundation

Life insurance has been called the foundation of your net worth. If you have a spouse or children, the initial stages of your financial strategy should include adequate life insurance coverage.

Read ArticlePlanning Ahead

To retire well, maximize your income strategies

We invest in what people buy. When an equity investment fund or stock is purchased, you indirectly invest in businesses relating to what consumers buy.

Read ArticleLife View

What is taxable in an estate?

After the death of an individual, every estate must file a final (or ‘terminal’) tax return. All assets are deemed to be disposed of at time of passing, and this can trigger probate fees and other expenses.

Read ArticleEstate View

Financial Strategies using Life Insurance

Life insurance needn’t be a boring topic. It’s the foundation of a sound financial plan. Moreover, protecting our family’s financial future is of great interest.

Read ArticleWealth Viewpoint Quarterly

Transferring RRSPs to RRIFs at age 71

Understanding transferring RRSPs to RRIFs RRSP Maturity Strategies: You are allowed to contribute to your RRSP up until December 31 of the year that you turn 71, at which point your RRSP must be closed. Instead, you can select any …

Read ArticleInvestor Insight

REVIEW How can mutual funds help manage financial risk?

How can mutual funds help manage financial risk? More significant gains are associated with both business success and variable risk in business and investment. Six risk factors and constructive ways to deal with them are examined below. Risk increases with …

Read ArticleMortgages

Mortgage planning to fit your financial strategy

If you’re seeking a mortgage, it’s a good idea to consider your mortgage as a crucial part of your overall financial strategy. A well-thought-out mortgage plan can help you navigate market fluctuations, protect your real estate investment, and give you …

Read ArticleInvestor Insight

Collective Investor Sentiment Affects Markets

Understanding Investor Sentiment While bull and bear markets describe sustained periods of market movement, the terms “bullish” and “bearish” describe investor sentiment and expectations for the market’s future direction. Bullish: A bullish outlook is characterized by optimism and confidence. A …

Read ArticleLife View

How life Insurance provides financial security

The primary purpose of life insurance is to provide financial capital for various family or business needs upon the death of the insured. Capital creation to provide financial protection Life insurance is a type of coverage that pays benefits to …

Read ArticleRegistered Investments

Life View

7 ways to remap your mortgage finances

It is important to plan ahead regarding your mortgage. A mortgage specialist can help you review your needs looking at developing your most advantageous financial strategies.

Read Article

Money management to mitigate tariff chaos

Recent trade policy developments have introduced a degree of market volatility and economic uncertainty. While it’s natural to notice these shifts, it’s important to view them within the broader context of long-term financial planning. For your investment portfolio, these evolving …

Read ArticleFinancial Viewpoint

A financial plan is essential for a secure future

When creating a plan for any significant life decision, such as choosing a career, getting married, or buying a car, we must spend hours reviewing lists to determine priorities and timing. We must have clarity as we develop our essential …

Read ArticleInvestor Insight

Weighing Strategies for Dollar-Cost Averaging

By investing in mutual funds over specific periodic intervals such as monthly or quarterly, you may or may not reduce risk.

Read ArticleMortgages

Mortgage planning to fit your financial strategy

As part of your overall financial strategy consider your mortgage strategies to access financing, reduce risk, and protect your real estate investments.

Read ArticlePlanning Ahead

Don’t let debt risk your future financial security.

The average debt-to-income ratio among Canadian families is now at a record high of 163 percent. This means that, for every $100 of disposable income earned per annum, the average family owes $163.

Read ArticleInvestor Insight

RESP: Saving for children’s and grandchildren’s education

Canadian legislation enables Registered Education Savings Plans (RESPs) to support education savings for children and grandchildren through specific provisions outlined in the Canada Education Savings Act and related regulations. Facts about an RESP A Registered Education Savings Plan (RESP) is a …

Read ArticleLife View

When Permanent Insurance makes sense

As the children get older and move out on their own, and your mortgage and other debts are nearly paid off, the need for life insurance capital designed to replace income for dependents decreases.

Read ArticleMortgages

Strategies to pay off your mortgage sooner

You can pay off your mortgage faster by increasing your monthly mortgage payments to pay more towards your principal, making additional payments on your mortgage, reviewing with your broker to find a better rate, or refinancing to shorten the amortization …

Read ArticleWealth Viewpoint Quarterly

Weighing the RRSP versus FHSA

Deciding between an RRSP and an FHSA depends largely on your timeline for buying a home and your current tax bracket. Since both offer tax deductions, the “winner” is usually determined by how you plan to use the money and …

Read Article

Mindful Finances

Mindfulness guides our best financial decisions. Dr Ellen J. Langer is the author of the classic book Mindfulness which details years of study of behaviour related to mindful thinking versus unmindful paradigms that form our reality. How we invest for …

Read ArticleInvestor Insight

Retirement is Looming: Give us a call

In the information age, we are inundated with data, to such a degree, we can get distracted from our principal wealth creation goals.

Read ArticleInvestor Insight

Understanding Investment Ascent: The Bull Market Defined

A bull market is a period of sustained growth and optimism in the financial world. It is a powerful upward trend, often characterized by rising stock prices, vigorous economic activity, and high investor confidence—like a bull confidently charging forward with …

Read Article

Long-Term Care Insurance (LTCI)

We face a rapidly ageing population. Since the 1920s, the ratio of seniors over 85 has more than doubled and continues to increase. Who will care for you in your old age? When our health is fine, it is hard to …

Read ArticleTax Tips Quarterly

A valid tax deferral tool in Canada

Governments have cracked down on tax loopholes and foreign banks which have allowed clients to circumvent tax legally due. If you have maximized your RRSP, are in a higher tax bracket, and may have a capital gains tax liability in your estate, you needn’t seek a tax haven offshore.

Read ArticleInvestor Insight

Is your money safe in a mutual fund?

One day your retirement income will flow from the capital you have been saving for years during thirty to forty of your working years.

Read ArticleInvestor Insight

The Well Prepared Investor

Many are asking essentially, “will I ever be ready to retire?” When we discuss the cause and effect realities with most who have not saved much for retirement we find they generally admit these reasons:

Read ArticleFinancial Viewpoint

Life insurance business strategies

Financial products and services address specific needs in your financial plan and help you build a successful business. As an advisor, I can access a broad range of insurance, investment, employee disability, and group benefits to help meet your individual …

Read ArticleInvestor Insight

Inflation: An increasing threat to financial sustainability.

Over the years, inflation reduces our buying power. Interest rates when increasing to reduce inflation also increase our debt repayment load as a percentage of income.

Read ArticleLife View

Bank of Canada reduces policy rate by 25 basis points

The following news is important regarding inflation, home sales, investments, and for people who carry debt: The Bank of Canada today reduced its target for the overnight rate to 4¾%, with the Bank Rate at 5% and the deposit rate …

Read ArticleEstate View

The Big Problem of Estate Capital Gains Tax

You and your heirs may think that all of your assets will pass over to them tax free. Let’s examine how estate taxation can erode the value of one’s property and cause business succession problems

Read ArticleInvestor Insight

6 mistakes that can keep you from building your nest egg

People behave according to their mindset. Some of the following thinking can keep one from putting their money to work, which could be achieved by buying equity investments such as equity investment funds. Psychological fear can also hold one back …

Read ArticleFinancial Viewpoint

Look through a wider lens to see life insurance at work.

Life insurance protects you against income loss, and the adverse effect less income can have on your family if one were to die or have a disability. As you build on that foundation by creating your assets and net worth, …

Read ArticleFinancial Viewpoint

Setting up your life insurance beneficiaries

It is wise to take a few extra steps to plan how you set up your beneficiaries on a life insurance policy.

Read ArticleMortgages

How to fully secure your home

Make Sure Your Home is Fully Secure Consider the following measures to take to ensure your home’s security: • Change all the locks when you buy a new home. • Add deadbolt locks and window locks where necessary. • Consider …

Read Article

Business Owners and Estate Planning

Entrepreneurs do think about retirement planning. Not all business owners, however, implement plans to allow them sufficient freedom to follow their leisure dreams. If you ask an owner of a successful small business if he/she plans to retire, you may …

Read Article

Disability Planning QUICK REVIEW

When you own your own business, you do not have the security of group insurance that employees have. After several years, you may find that you are drawing a substantial income from a successful venture. Disability Planning: Let’s do a …

Read ArticleLife View

A Strategy for Extending Aging Elder Independence

Here is an interesting method for watching over feeble parents from a distance. In some cases this strategy may be able to help an elder parent maintain independence at home. I share below a good friend’s strategy. After reading this …

Read ArticleInvestor Insight

Wealth Creation in cyclic markets

If you are an investor who remembers the mortgage debt crisis of 2008-9, you know that the market lost significant value. From an investment standpoint, the real downside occurred precisely when some investors sold off their equity holdings due to fear mid-way or near the end of the market devaluation.

Read Article

How life Insurance protects your financial foundation

Life insurance has been called the foundational strategy of building and protecting your net worth.

Read ArticleEstate View

Solutions for your Estate Plan

An estate plan prepares in advance for the distribution of your wealth at the time of death in the most tax advantageous way. Here are a few strategies to accomplish this. Estate planning is generally done years ahead, to avoid taxation pitfalls that can erode wealth transfer to heirs.

Read ArticleInvestor Insight

Why is portfolio strategy important?

Understanding your risk tolerance: Each of us has a personal level of risk tolerance, which indicates how much risk one is willing to take while investing in markets that always go up and down. Your advisor can help you set …

Read ArticleMortgages

Remapping your mortgage finances

Plan your mortgage shopping. The Bank of Canada just reduced the interest rate to 3% on Jan 29, 2025. It is essential to plan regarding your mortgage. A mortgage specialist can help you review your needs to develop your most beneficial …

Read ArticleInvestor Insight

Greed and Fear: The dilemma of investing without an advisor

Many people get caught up timing the market, when influenced by either of the two emotions, greed or fear. Here’s why this never works.

Read ArticleInvestor Insight

Cognitive Biases and Investment Decisions

Cognitive biases can impact business or investing decisions

Read Article

Get a Financial Plan for Wealth Creation

Your advisor is the foundation of the four cornerstones of your financial plan. He or she can help guide you with knowledge and expertise to meet your specific goals.

Read ArticleInvestor Insight

Estate considerations when using the RRSP vehicle

RRSPs alone may not be best for the wealthy The following chart indicates that you can save a small fortune over time in an RRSP. Since your focus is on retirement, much of your wealth may accumulate using this registered vehicle. …

Read Article

Mortgage Life Insurance Strategies

Mortgage Life Insurance from the financial institution Premiums can be much higher. The death benefit replaces only the remaining balance of your mortgage balance. Premiums do not reduce when your mortgage debt is reduced. The death benefit only pays off …

Read ArticleTax Tips Quarterly

Business Tax Planning

Business Tax Planning If you own a business, and your children and/or spouse work therein, consider paying them a reasonable salary from the business. If this is their only income, or they only work part-time elsewhere, they may not need …

Read ArticleLife View

The smart alternative to mortgage life insurance

Your mortgage lending institution generally sells creditor insurance to ensure that upon the decease of the homeowner, they will not be burdened with an unpayable debt.

Read ArticleInvestor Insight

Matching asset portfolios to your risk profile

One of the most critical factors in choosing an appropriate investment portfolio is understanding which asset allocation best matches your investing goals and risk tolerance. No two investors are entirely alike; as such, the asset allocation of your portfolio must …

Read ArticleInvestor Insight

The perils of cashing out in volatile markets

Though volatility has been frequent, Dow Jones has risen substantially through the waves of buying and selling trends. During the pandemic, panic selling occurred in March 2020 but recovered despite volatility. Moreover, a bullish buying period ensued into April 2022, …

Read ArticleInvestor Insight

Balancing Investor Risk and Reward

The risk/reward concept states that the higher the risk of a particular investment, the higher the possible return. Although there usually is some risk with any equity investment, it is essential to assess just how much risk your portfolio should carry. Risk involves the potential for gain or loss of monies invested.

Read ArticleFinancial Viewpoint

Advice by Design with Planning Values

Here are some essential strategies that will help you achieve financial independence. As the graph indicates, it is important to get solid advice to guide you with financial strategies incorporating planning values such as those noted. Separate your savings from …

Read ArticleBusiness

5 Options of a Buy-Sell Agreement

When a co-owner/partner dies, the surviving business owners usually have five options in dealing with the deceased owner’s business interest: 1. Buy out the heirs of the partner with Life Insurance proceeds. This is usually the most preferred option. After …

Read ArticleInvestor Insight

Fear – the stumbling block of DYI investing.

Many do-it-yourself (DIY) investors who do not use an investment advisor may have missed excellent returns as the market has revived beyond expectations. Interest rates were up, US banks were failing, and recession fears had loomed since January 2023. Fear …

Read ArticleMortgages

When is the best time to sell or buy a new home?

People begin putting their homes on the market early in the year, though peak home purchasing occurs around June once school has ended, the weather warms up, and vacations begin. In mid-summer, people begin to have more time to house hunt. Income tax refunds can also increase payments, adding to the increase in volume.

Read ArticleBusiness

Disability Buy-Sell Agreements

Two strategies protect shareholders against the liabilities of another significant shareholder becoming disabled.

Read ArticleInvestor Insight

How market volatility can work for the investor

Volatility is when prices of stocks and equity funds increasingly shift in value up or down.

Read ArticleMortgages

2023 FRAUD REVIEW: Be vigilant about fraud.

While a determined hacker targeting an individual will eventually be able to overcome any security precaution, most of us will never be so specifically targeted. Maintaining basic security hygiene and awareness would be enough for us to protect ourselves against …

Read ArticleFinancial Viewpoint

Calculating CPI at Statistics Canada

The Canadian government uses an inflation measurement called the Consumers Price Index (CPI), calculated by Statistics Canada. A simple average of prices in Canada doesn’t accurately represent how the average Canadian spends money or how that modifies their purchasing power. …

Read ArticleLife View

When the family begins: Protect your family finances.

If you have a spouse or children, make sure you have adequate life insurance coverage. Here are 7 tips about life insurance.

Read ArticleInvestor Insight

Over-consuming leads to under-investing

Some people never pay themselves first. After most people have paid for their necessities, there seems to be little left over for investing. This dilemma is often based on a certain mindset.

Read Article

Increased Wealth Protection

Permanent Life Insurance can provide wealth protection that becomes especially attractive after clients have maxed out both their registered retirement savings plans (RRSP) and tax-free savings accounts (TFSAs) with money to spare which can pay for the ongoing premium. When considering your potential future tax liability, compare it to the effect that inflation may have on the life insurance’s future lowered buying power.

Read ArticleInvestor Insight

Investing is a strategic process, not the final goal

Investing is the strategic planning process, not the final goal It is important to realize that investing is not the goal. The goal is based on a future result that you aim for using mathematical calculations. Investing is what you do in …

Read ArticleInvestor Insight

Cyclic Bull and Bear markets can play on investor sentiments

Two significant cycles frequently occur in the market that many investors are psychologically affected by—the Bull and the Bear market—when market values rise or fall significantly. When it comes to investing, many procrastinate. If they monitor these cycles too closely, …

Read ArticlePlanning Ahead

Let’s get rolling on your financial planning!

David Allen is the guru of organising email, meetings, events, and anything to do to maximise your business and life productivity. After years of advising wealthy corporations on efficiency, he wrote: The real issue is how we manage actions. …

Read ArticlePlanning Ahead

Chasing Peace in a Vacation Resort

Many people think about getting away in January and February to get some sunrays to escape the cold of winter. If you are over 55 years of age, you may be less into adventure, and prefer to have a calming rest in a warmer climate.

Read ArticleMortgages

Facing further Mortgage increases

A home is the biggest purchase most people make in life. It is important to proactively weigh your options by working with a mortgage consultant to manage the cost of borrowing because it may save you a small fortune over the years.

Read ArticleMortgages

Unpacking 3 major components of a mortgage

A mortgage payment generally consists of several components: the mortgage principal and interest, property taxes and mortgage life insurance.

Read Article