A study reveals the importance of income security.

During the 70s in Canada, the Canadian government chose a town at random — Dauphin, Manitoba, a small town on the prairies — to conduct an unprecedented experiment.1

A large number of the people in the town were paid $16,000 per annum for three years (in today’s Canadian currency) without strings attached.

During this time, the researcher, Dr Evelyn Forget, of the University of Manitoba, found that this universal basic income test yielded the following results: a correlated decrease in depression, anxiety, and other forms of mental illness. Over three years, hospitalizations due to mental illness fell as much as 8.5%. Compare that to the past decade, where global depression rates have risen by 18%.

This makes it clear that a good financial plan needs to incorporate both a systematic investing plan and disability income replacement plan while working. The disability income, if ever needed, helps you to stay on track with sufficient income resources during the accumulation years while you invest for retirement. And income paid out as the disability replacement benefit can relieve anxiety that may help the healing process if you are incapacitated for any length of time during the years before retirement.

Moreover, a disability insurance policy can provide you with a replacement income (generally around 70%) while you recuperate yet continue to remain in the workforce. Add to this a Critical Illness benefit plan designed to assure that capital would be available to provide income or a lump sum of capital if you cannot return to work due to one of many life-threatening critical illnesses.4

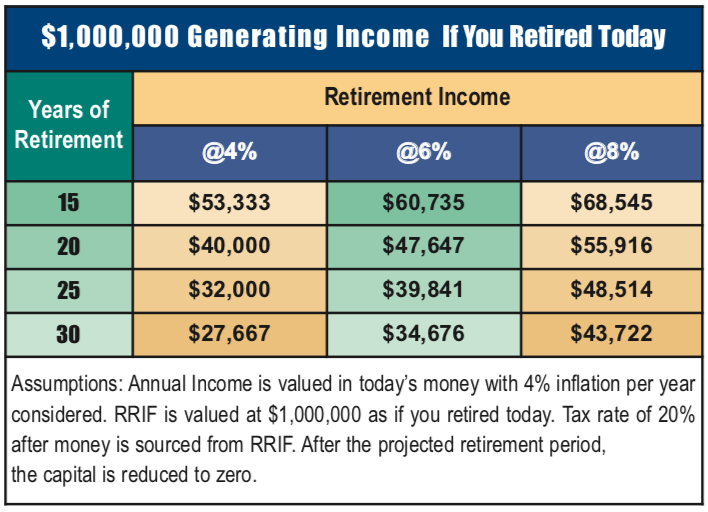

The following graph shows how many years of retirement income can be provided by one million dollars at various rates of return.

Chart by AdviceonMedia

1 A study by Dr Evelyn Forget, of the University of Manitoba.

4 Depending on the policy, life insurance and disability policies as well as Critical Illness policies can carry on, some providing lifetime income.