If you are approaching retirement, you may have witnessed someone become critically ill due to illness or an accident. The actuary Frederick Vettese, in his important book published in 2015: The Essential Retirement Guide: A Contrarian’s Perspective.

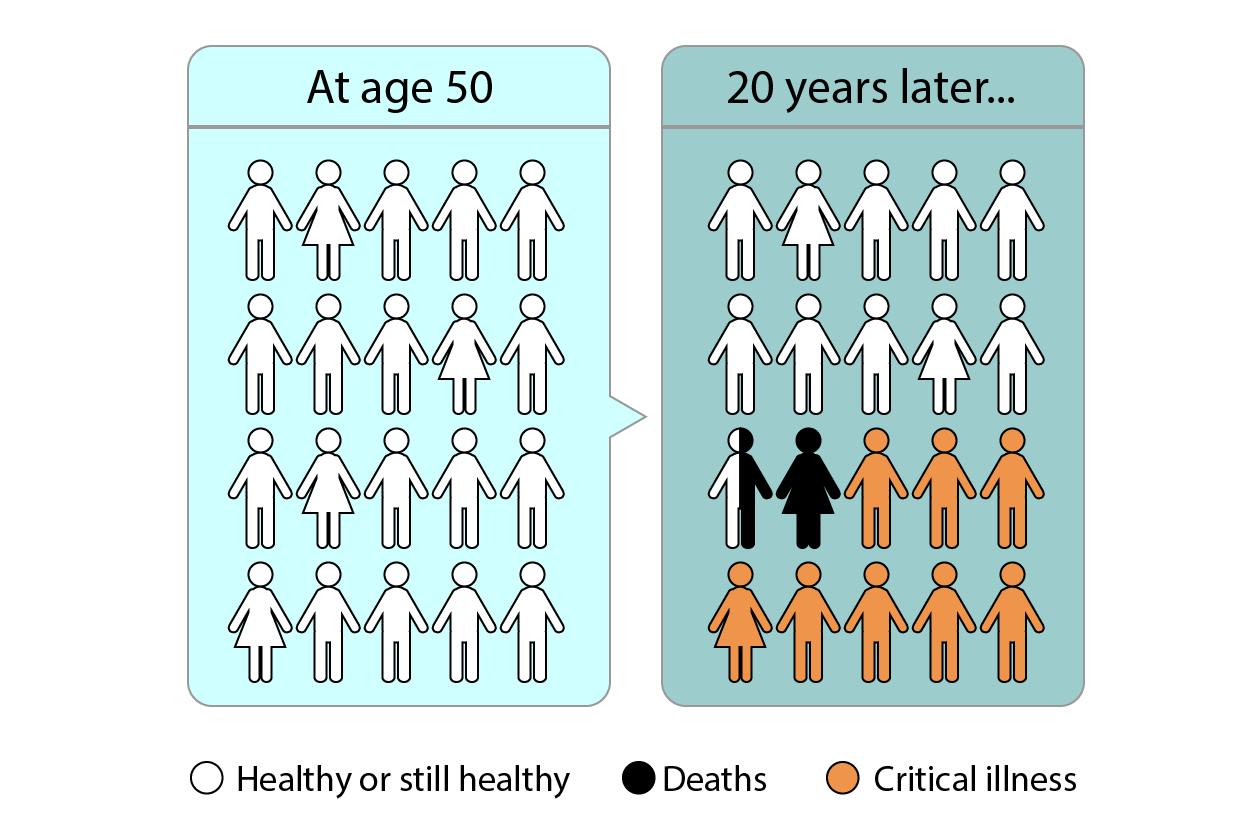

He indicates that we need to be aware of the fact that though we plan for an encouraging future, we understand that risks increase with age as indicated by the following simple diagram. Most of us are living longer than previous generations, yet we have a 50% chance of making it to 70 years old before we die or succumb to a critical illness such as cancer or cardiovascular disease.1

Source: Canadian Critical Illness Tables (2008), reconfigured by Morneau Shepell

Critical Illness Insurance is a plan contracted with a life insurer typically to make a lump sum cash payment if a policyholder is diagnosed with one of the critical illnesses listed in the insurance policy. Statistics reveal that more and more Canadians, increasingly into the retirement years will be afflicted by a critical illness. In addition to having to face a serious illness, important costs related to medical treatments are not covered by provincial health insurance plans. These policies can cover illnesses such as:

- Cancer

- Coronary Bypass

- Heart Attack

- Stroke

- Alzheimer’s Disease

- Aortic Surgery

- Benign Brain Tumour

- Blindness

- Coma

- Deafness

- Heart Valve Replacement

- Kidney Failure

- Loss of Limbs

- Loss of Speech

- Major Organ Transplantation

- Major Organ Failure (on waiting list)

- Motor Neuron Disease

- Multiple Sclerosis

- Occupational HIV Infection

- Paralysis

- Parkinson’s Disease

The policy may also pay out regular income to a policyholder undergoing a surgical procedure, such as having a heart bypass operation. It may require the policyholder to survive a minimum number of days — usually 30 days — from when the illness was first diagnosed.

Frederick’s Vettese’s book helps put these truthful statistics in perspective – prepare us for forward thinking – offering us awareness as part of your retirement reality check as you plan your finances. Most people in their 50s think they have 30 to 40 years or more to live, and good financial planning also must beware of this potential. When you look at these two parameters: 1) I may live 20 years without a critical illness, balanced with the upside potential, that 2) I may live 30 or more years in retirement with a healthy lifestyle. Thus, we need to plan to accommodate risk, taking everything into account. A balanced view might ask: “should I retire earlier due to the health risks?” Others who have not met their retirement savings goal may weigh in the need for more sustainable savings and ask “Should I work longer and defer creating an income from my retirement savings?”

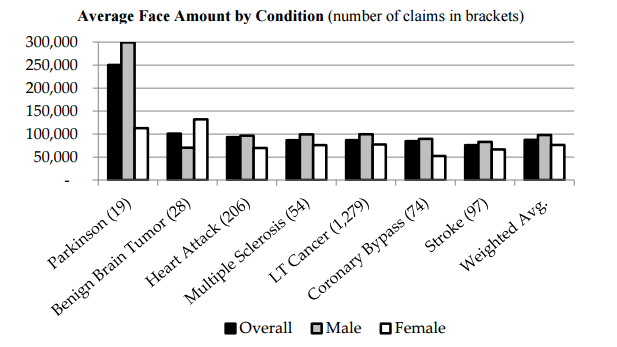

Assessing 1,823 claims, a study among four insurers in Canada found that the average face amount of Critical Illness claim for a benefit in the study was $88,418. 2

Though we can exercise and eat healthy foods to mitigate our risk of disease affecting our secure retirement, we must be knowledgeable of the real measurable risks that we all face in life.

Give us a call or contact us via this website. We are happy to review your situation.

1 Vettese, Frederick (2015). The Essential Retirement Guide: A Contrarian’s Perspective (Wiley)