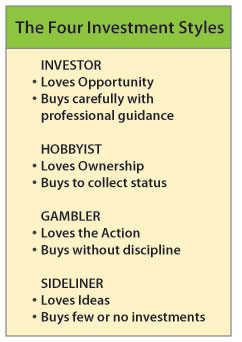

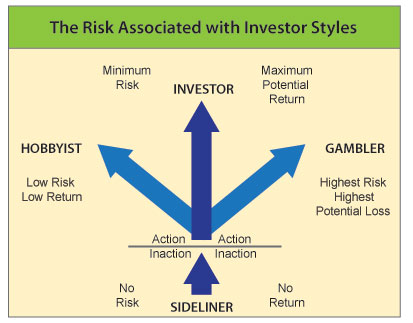

There are four basic types of people, each with a distinct mindset when approaching investing: the Sideliner, the Gambler, the Hobbyist, and the True Investor. To become a serious and successful investor, you must consciously recognize and avoid the erroneous attitudes of the Sideliner, the Gambler, and the Hobbyist.

The Sideliner Sideliners aren’t afraid to take action as long as they are in the audience, where they won’t ever get bruised. They shout, stand, and clap, loving the action of a bystander. Sideliners love the excitement of stock market news and the thrill of the investor’s game. They often examine how the indices, a stock, or a fund performed. Observation alone never gets you into the game of investing. Sideliners may feel it is dangerous in the arena of the investor.

The downside of Sideliners is that they are analytical, love to run numbers, and hope to reduce most of the risk by comparing return percentages. Yet, out of a paralysis of information, fear sets in, and they make minimal purchases just to play it safe. The sideliner is a silent observer who possesses discernment for weighing facts, yet witnesses other people’s investment success without taking any action to enjoy investing personally.

The Gambler. These people are sanguine thrill seekers who, unlike the Sideliner, enjoy the casino, horse racing, or scratch-and-win tickets. He or she confuses play gambling with risk tolerance, spends recklessly, considers that investment principles are for misers, and doesn’t seek the guidance of an advisor and consequently has a retirement portfolio that looks broke.

The downside. The Gambler is often comfortably numb and usually suffers frequent losses for taking above-average risks. They might buy an investment based on listening to the talking heads in the trading media, purchase penny stocks, or low-priced stocks of failing companies — all based on uncredentialed hearsay. Because they think they might make some quick money, they believe they are investing, but they are not. Rarely does a Gambler stay invested for the long term.

The Hobbyist. He or she buys things and investments based on their emotional value, rather than their investment value. As collectors, they buy for the sake of popularity, notions of status, aesthetic gratification, and pleasure.

The downside. Hobbyists are those who, when excited, may jump at the chance to buy anything recommended to them by word of mouth or a talk show host. They may own all the British Royal plaques on a wall or the top “500 must-see movies before you die”. The financial perspective can get lost because several investment funds may be purchased based on historical popularity instead of their potential for future gains. Because collections have been known to appreciate in value, they believe they are making an investment. They do not understand the old Latin proverb “Non Quantum Sed Quale”, meaning it is not the quantity, but the quality that counts.

The True Investor. By utilizing an advisor’s wisdom, they make informed decisions about good investments. Unlike Sideliners, they act. Unlike Gamblers, they minimize risk. Unlike Hobbyists, they buy based on investment value. Investors are defined by their knowledgeable expectation for financial gain, employing a principled process to minimize financial risk. Many also make it their practice to utilize professional managers and advisors when investing.

True investors act the part, with a vision to achieve excellent returns on their investments while exposing themselves to mitigated risk that suits their investment profile, and enjoy the actions that lead to real financial success. It all comes down to how you think and if you’re thinking towards taking investment action.