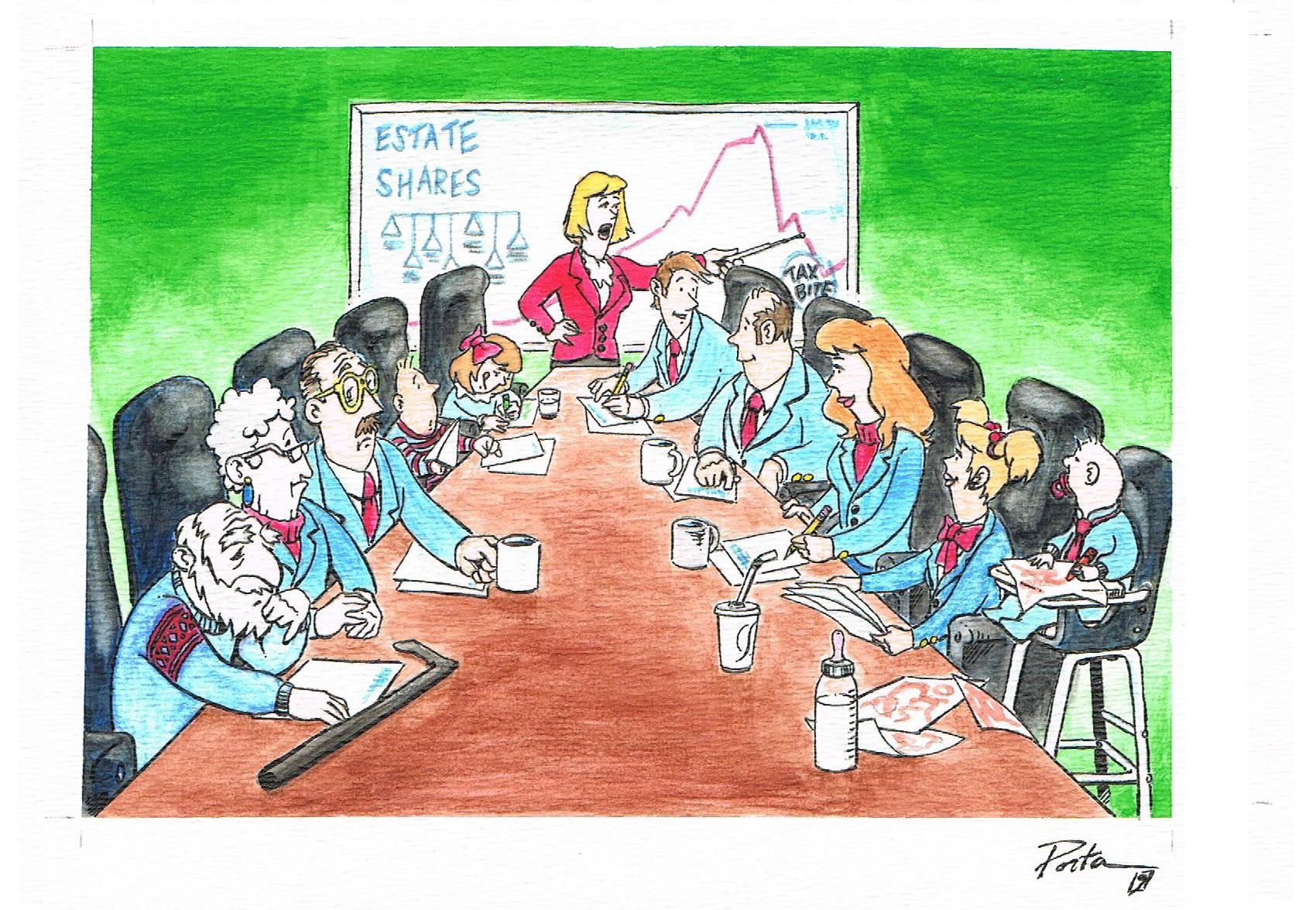

Co-executors share authority to oversee the distribution and probate of your estate.

Before naming or agreeing to act as an executor, consider the level of complexity of your estate. If you name your spouse or child as an executor, a co-executor such as an attorney can offer guidance in a complex estate. A co-executor can also help ensure beneficiaries that their inheritance is being managed accurately according to your Will’s instructions.

A testator drafting a Will can aim to avoid conflict by considering joint executors. When nominating co-executors, a testator should:

• Create accountability and transparency by appointing executors who will not have a conflict of interest when distributing assets.

• Consider tagging intimate belongings that have a personal value for certain people, for example, a photo of your high school football team, to your son who also loved football; or your favourite camera to a child who enjoyed photography with you.

• Consider if your estate needs a professional legal and accounting executor that has experience in estate planning. You want to assure that your estate is executed fairly, in accord with accountancy law.

• By assigning joint executors you establish mutual accountability, reducing any temptation for one person to overstep his or her authority to take from the estate what must divide among heirs. It is not unusual for one to remove furnishings, cameras, keepsakes, family photos, lawn and garden equipment, or valuable collections while offering weak evidence of accounting for any goods sold.