The Federal Budget 2015 has introduced a new withdrawal requirement for your Registered Retirement Income Fund (RRIF).

Retirees are living longer into retirement. This necessitates a new mathematical model for withdrawing income over this extended period of time. It also allows for better integration of income from Tax-Free Savings Accounts (TFSAs) which many Canadians are opting to use.

For example, the old rate was 7.38% for the 1st withdrawal if it began in January 2014. The new rate is less at 5.28%, moving up to 18.70% by age 84, and leveling to 20% minimum withdrawals at age 95.

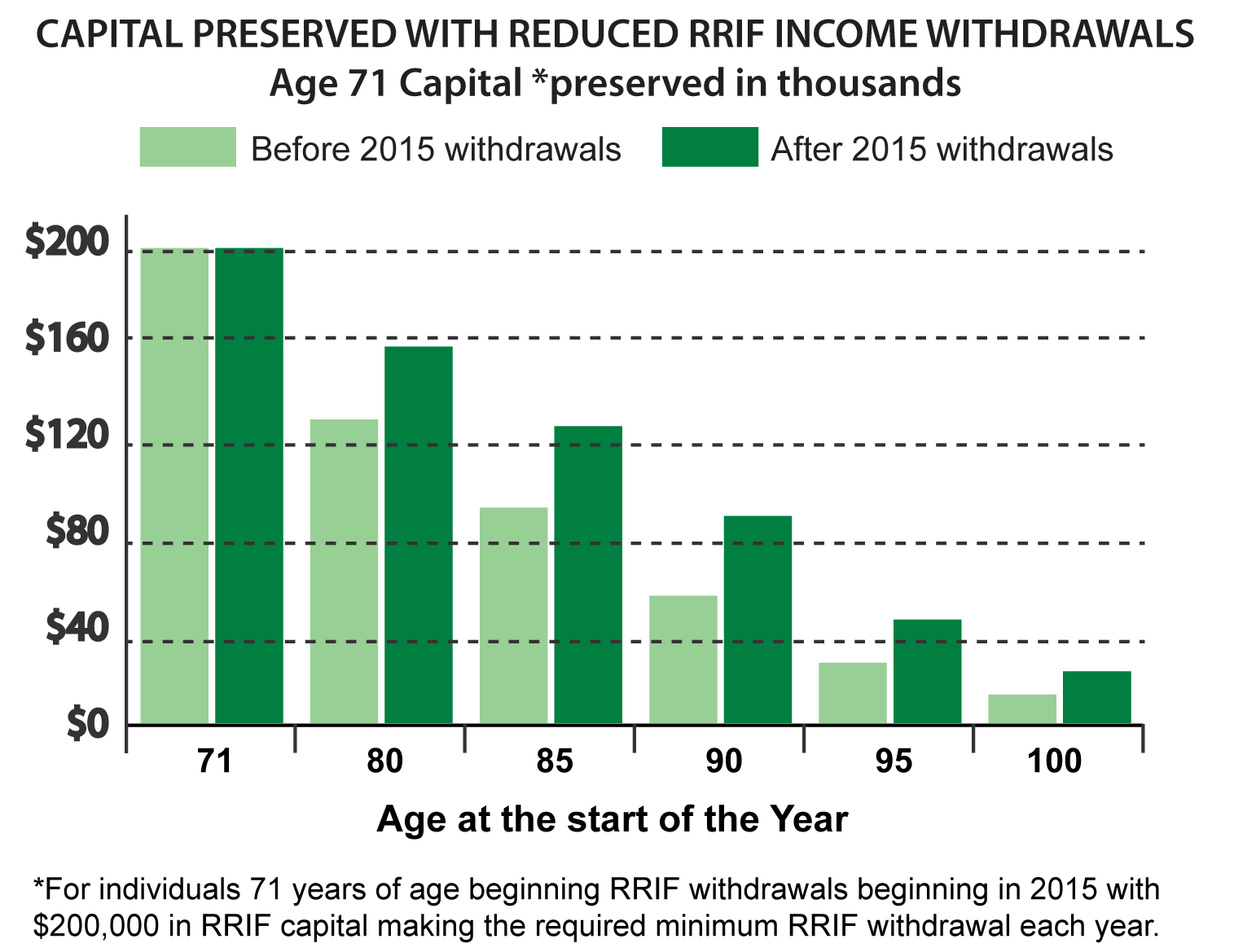

This will allow a retired senior’s money to last longer into a longer retirement period. It is especially helpful based on the low-interest rates available today and the potential critical effect of inflation. The following graph from the CRA shows how it works.