Retirement planning is strategic

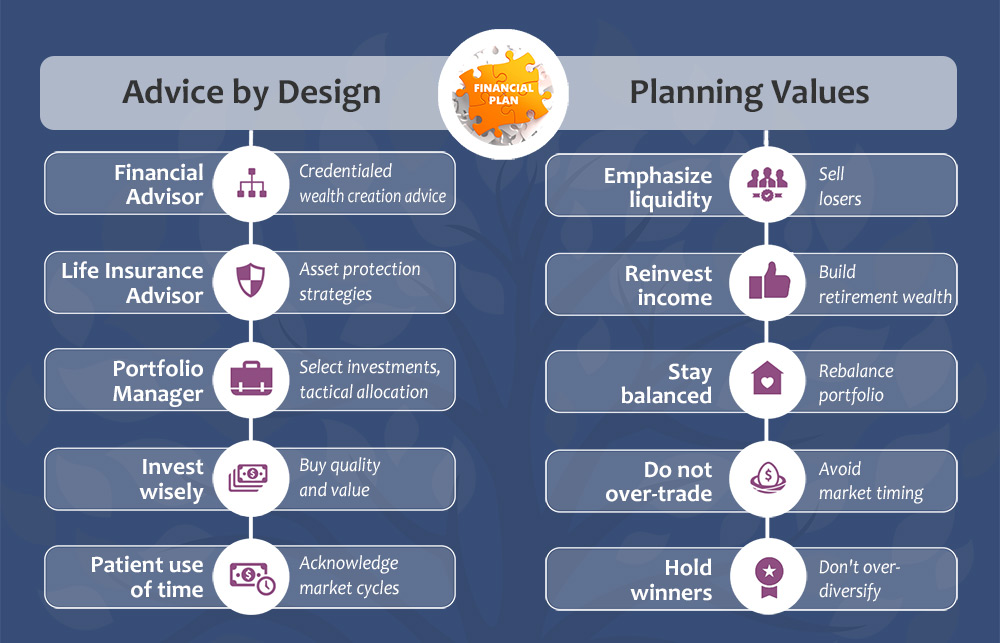

There are many factors to consider to develop a strategic financial plan. This is why financial advisors apply their trained expertise to organize a strategy in the following key categories designed for your future retirement security:

- Net worth Add up all your assets and subtract your liabilities to get your financial net worth.

- Retirement income resources Within your assets of your net worth, determine the specific amount earmarked as saved for retirement from which to draw an income for a lifetime. Bear in mind that some of your assets will be fixed (not liquid for cash) such as your residence.

- Weigh debt interest against investment interest Debt accumulation must be mastered as it will drain any good retirement plan.

- Expiration potential of income resources Based on how long you might live – your life expectancy – calculate just how much cash the funds can deliver for your lifetime per month. Then based on how much you determine you will really need to cover expenses per month, calculate when the money would run out or if you have enough saved to last a lifetime. Add in pension income sources. Income resource planning needs to accommodate reasonably achievable long-term goals while considering your risk tolerance.

- Investment action plan A systematic method of investing helps counter the effects of inflation.

- Invest with a mind to save tax Utilize all the tax planning strategies available with the government’s registered accounts.

- Invest for wealth creation If you have five or more years left you must invest if you haven’t reached your necessary accumulation from which to draw an income. Seek investment advice from a professional advisor.

- Invest for wealth preservation Once you have accumulated your nest egg, develop strategies to help protect against a capital loss, yet remain invested in suitable vehicles for your age. The following graph will denote how much money is necessary for a prolonged period of time in retirement.

- Get good investment advice There is the need to use a financial advisor who works in the realm of financial calculations while looking at your future income needs.