If you have a conventional mortgage at your bank, you normally get paperwork indicating it is about to renew when the term is ending. You may be offered quick renewable solutions to renew easily and stay with the current institution.

However do not presume that you have the best possible rate, term or advice until you talk to your advisor who can broker your mortgage among several lenders. Examine the rates and the terms. You may be surprised to find that you can cut your interest rate by one or a half an interest point.

A $200,000 mortgage over 20 years at a 4% rate will cost you $90,871 payments in additional interest, whereas at 3.5% it will cost you $78,381, which is $12,490 less. In just five years you could save $891.37 more in interest proving that a half percentile difference of interest makes a big difference among lenders.

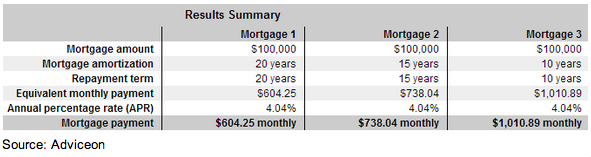

Once you get your lowest rate, calculate increments of 5 years, for example 20, 15 and 5 years to see how you might be able to shorten the payment period with your lower rate. By paying only $133.79 more per month at 4.04%, a mortgagee could shorten a 20 year $100,000 mortgage by 5 years, to 15 years.

Call your advisor when your renewal notice shows up in your mail.