Category Archives: Uncategorized

Investor Insight

Current Market Update

Here we provide a snapshot of some important financial indices for your perusal. The market indices herein information is provided “as is” and solely for informational purposes, not for trading purposes or advice, and may be delayed.

Read ArticleMortgages

What type of home should you buy?

There are several home types to consider before buying your new home:

Read ArticleMortgages

How much will the new home really cost?

Once you have figured out the home price range you can afford and the type of mortgage you qualify for, you will need to calculate all of the associated costs of the transaction to make sure you are financially ready.

Read ArticleInvestor Insight

High debt ratios can destroy your retirement

Many people get into serious debt, way over their heads, because they don’t keep their debt manageable—meaning they can’t repay their debts. For this reason, many cannot begin to save sufficient income for retirement.

Read ArticleLife View

Have you had your financial health checkup recently?

To know the state of your fiscal health, you must have a personal financial health check up. Your financial advisor will help put perspective on your diagnosis and how in shape you are for retirement.

Read Article

Many seniors are being ripped off by fraudsters!

Consider that major Internet websites of Google, Yahoo, Twitter, the US Government have been compromised — any site online is hackableConsider that major Internet websites of Google, Yahoo, Twitter, the US Government have been compromised — any site online is hackable.

Read ArticleFinancial Viewpoint

Won’t get fooled again!

The Whos song “won’t get fooled again” won’t help if you have been held hostage by a ruthless scammer!

Read ArticleMortgages

Homeowner Mortgage Default Insurance

Canada Mortgage and Housing Corporation (CMHC) provides Homeowner Mortgage Loan Insurance, which is required by law to insure lenders against default on high-ratio mortgages.

Read ArticleEstate View

Investor Insight

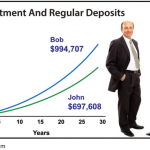

Increment to increase your retirement income

You may be making your own or employee sponsored contributions to your RRSP. If you increase your contributions by just 3% per annum, you can increase your accumulation over 30 years!

Read ArticleEstate View

Executor planning and the family business

If you own a business or a partnership, which has a buy-sell agreement with partner-beneficiaries, this portion of the estate needs a trusted executor who is privy to your business.

Read ArticleLife View

Naming co-executors of your estate

Co-executors share authority to oversee the distribution and probate of your estate. Before naming or agreeing to act as an executor, consider the level of complexity of your estate. If you name your spouse or child as an executor, a …

Read ArticleBudget Review

Federal Budget 2016-2017

In its first budget, Bill Morneau, the Minister of Finance revealed the new government’s 2016-2017 Federal budget.

Read ArticleReal Estate

Understanding mortgage amortization

Amortisation refers to the number of years it will take to repay your mortgage in full. When you use 20% or more of the purchase price as your down payment, you can select up to 30 years over which to …

Read ArticleLife View

Powering up life insurance benefits

Where one child inherits the family cottage or another asset of significant value such as a business, consider leaving equivalent cash assets to other siblings. If there will not be enough cash in the estate, life insurance can be purchased …

Read ArticleInvestor Insight

Understanding asset allocation

Affecting both risk and return, asset allocation is the procedure of apportioning investments among various categories of investment fund assets to design the most advantageous counterbalance of risk versus reward. The objective is to reduce risk while maximising the …

Read ArticleEstate View

Understanding Executor Powers

An executor carries out the instructions in your Will. Jurisdictional laws define what the executor must do, whether they are a friend, relative, professional, or a trust company—however, the Will can specify even more extensive powers. The executor may have …

Read ArticleEstate View

Life insurance helps create a smart estate plan

Where life insurance planning is in place, cash benefits can redeem your share’s value upon your death, and your partners can take over the business. Debts can be redeemed, and key-man insurance can ensure that there are funds available to sustain the transition or expansion.

Read ArticleInvestor Insight

Avoid emotional rollercoaster investing.

It is important to invest with calculated thinking, with a written financial plan utilising experienced investment guidance.

Read ArticleEstate View

The real rate of return of a death benefit can enhance your estate planning.

If you do the mathematics on the internal rate of return that can be received tax-free on Term to 100 life insurance policies, you quickly learn that developing a death benefit for your estate can be an effective tax tool.

Read ArticleMortgages

Is owning a home right for you?

Remember that buying a home is one of the biggest emotional and financial decisions you’ll ever make, so prepare yourself to make a knowledgeable decision.

Read ArticleLife View

Control your Estate Tax Liabilities

Plan to reduce taxes in your estate. When transferring your assets using a will, try to pass as much value as possible to your heirs. If you hold equity investments such as stocks, they may have accrued capital gains.

Read Article

Tax-Free Savings Account (TFSA)

A TFSA is a registered savings account that makes it easy for Canadian taxpayers to earn investment income, as the title states, tax-free. A TFSA allows you to save money while avoiding taxation on investment income on the after-tax monies …

Read ArticlePlanning Ahead

Teach your children about strong financial values

Peer pressure can directly influence how much it will cost to raise your children. Teach them how to develop good stewardship now so monetary responsibility becomes a part of their character development.

Read ArticleInvestor Insight

Are you investing for your retirement to last a lifetime?

Will you be ready to retire financially independent for 20, 30 or more years? Are you carefully planning using mathematics?

Read ArticleMortgages

Establishing your Mortgage down payment

Accumulating a down payment for first-time homebuyers, and/or a reno can be a challenge. Many younger adults have other obligations such as student loans, rent, and basic monthly expenses.

Read ArticleBusiness

Business Partners collaborate to form a Buy-Sell Agreement

Whether you own a partnership or corporation, a buy-sell agreement is essential.

Read ArticleInvestor Insight

Investing for your long term goals

When you have a longer time horizon before retirement or sending your children off to university or college, there are some things to consider about your investment portfolio.

Read ArticleBusiness

Thought about selling your business if you are disabled?

Let’s take a look at two preventative financial maneuvers to guard against potential liabilities if a shareholder became disabled.

Read Article

Students offered loan repayment relief

Approximately 750,000 students were repaying Canada Student Loans over the period of 2013 to 2014. As reported by CTV News the federal government of Canada is offering to assist post-secondary graduates paying student debt. Employment and Social Development Canada, as of Nov. 1, informs that Canadians will not have to repay their Canada Student Loan if they are earning under $25,000 a year.

Read Article

6 Ways to Add Muscle to an Out-Of-Shape Retirement Plan

The need for income for the long run, the exhausting effect of inflation, the worry of potential medical or long-term care, and retirement costs may now haunt you.

Read ArticleEstate View

7 Ways that Income Replacement Insurance Protects the Family

If you were to become disabled, where would your income come from? An Income Replacement Insurance policy can solve that problem. Here are 7 things you should know about this financial planning tool designed to protect your income.

Read Article

How can you find the right home?

Once you figure out what you can afford to pay for a house and obtain a pre-qualified mortgage, you are ready to start your search.

Read Article

Are you watching your vacation expenses?

The typical adult spends up to $300 per day to travel on the road out of his or her region, for auto or transit; hotel or resort; art galleries and entertainment; souvenirs and dining.

Read ArticleBusiness

Business: Group Benefits and employee addictions

Ten percent of the Canadian population report symptoms consistent with substance dependency.

Read ArticleFinancial Viewpoint

Guarding your retirement income plan

You have worked hard to achieve your retirement savings to date, and as you approach retirement, it will be increasingly important to protect your nest egg that will provide your future income stream.

Read ArticleReal Estate

Ask 12 Questions Before Insuring Your Home Mortgage

Here are several questions for you to ask if you consider buying mortgage life insurance through a lending institution or the alternative route to gain control.

Read ArticleTax Tips Quarterly

The new Canada Child Benefit (CCB)

As of July 20, 2016, Canadian families can find out what the potential value of their monthly payments from the new CCB will be.

Read Article

What ways can we plan for our Child’s education?

Consider using both the traditional Registered Education Savings Plan (RESP) and the Tax-Free Savings Account (TFSA) contributions as education savings vehicles.

Read ArticleBusiness

Do I need a Buy-Sell Agreement?

Whether you own a partnership or corporation, we can help you set up a buy-sell agreement while you are alive and capable of doing so.

Read ArticleInvestor Insight

You can contribute to your partner’s RRSP

A Spousal RRSP can ensure that future retirement income is split between two spouses. This may help to reduce a higher tax bracket when you have more taxable income in your retirement years.

Read ArticleEstate View

Business Owners: Are you investing for your retirement?

A business owner may believe that their company will continue to thrive and provide investment capital when sold, or if passed on to the next generation can create a salary or dividend payments. For some, their personal financial stability is riding only on the future success of the company.

Read ArticleInvestor Insight

Will you be able to fund your retirement?

Many believe that a million dollars is a large nest egg and is much more than anyone will need to retire on. However, this will depend on many factors such as: your life expectancy if you are single person; or the longest life expectancy of two life partners; inflation rates; and, rates of return on your investments.

Read ArticleRegistered Investments

Education planning has serious financial consequences

As parents, we need to consider the effect that education will have on the future income and lifestyle of our children. When Steve Jobs of Apple knew he had a short time to live, he became assertively interested and vowed that he would do everything in his power to ensure that his son received a good education!

Read ArticleEstate View

An Estate Plan for the business and the family

A comprehensive estate plan includes a will, a plan to minimize the capital gains liability and provide for any family income needs. This often involves life insurance which is an effective tool to maximize the size of your estate and pay any tax liability cost effectively.

Read ArticleInvestor Insight

Why you need an investment manager in the summertime

Investment managers understand that the summer is a period when there can be more volatility in the market. This is because many investors prefer not to attend to their own private investing during periods when many are enjoying relaxing during their holiday time off from work. A common phrase is “sell in May and go away”.

Read ArticleMortgages

Increasing your home’s accessibility

Making homes more accessible for people with disabilities or aging parents, is a growing demand for builders, contractors, interior designers and homeowners.

Read ArticleBusiness

Business Owners: The Importance of an Estate Tax Plan

Many are not convinced that they need to plan their estate or the succession of their business. Despite the financial importance of their business, most business owners do not know what the tax liability would be if both spouses were to die.

Read ArticleEstate View

How do you deal with RRSP transfers upon death?

When RRSP assets are present in an estate, there are a few steps to follow to assist transferal in the event of inheritance, death or separation.

Read ArticleEstate View

Potential Legal Issues for Trustees and Executors

Probate fees were the forerunner of the new Estate Administration Tax (EAT). In Ontario, the Probate/EAT fees are currently administered by Ontario’s Ministry of the Attorney General, and shifting to the Minister of Revenue with the new legislation. In 2013, an Executor/Trustee will have to file a detailed summary of assets that are to be distributed under the will.

Read ArticleInvestor Insight

Does an investment’s volatility imply risk?

The wisest investors do not avoid volatility— rather they understand the difference between risk and volatility. Some may view volatility as risk especially if they see the stock market lose some value in relation to their own investments for a …

Read ArticleEstate View

Protect your Wealth: Know how executors pay off estate debts

Regardless of solvency, money is paid to creditors from the estate assets first. If debts are high, this can deplete an estate’s assets leaving little for family heirs. Consider talking to us to review your life insurance beneficiary status in view of estate planning.

Read ArticleTax Tips Quarterly

Personal Tax: Changes that may effect you

There have been a number of tax-related changes in the recent 2016 federal budget – here are a few:

Read ArticleReal Estate

The necessity of a licensed mortgage agent

The Canadian media has been showered with articles and studies this year, as many Canucks are sleepily stunned by what has happened to the Canadian Real Estate market in our key cities. Some think it has been wealthy foreigners buying up our best houses and lands.

Read ArticleMortgages

Mortgages: Are you financially ready?

You will need to evaluate your current financial situation, how much house you can afford and the maximum home price that you should be considering.

Read ArticleFinancial Possibilities Magazine

Criticall Illness: Mitigating risk in retirement

We need to be aware of the fact that though we plan for an encouraging future, we understand that risks increase with age as indicated by the following simple diagram. Most of us are living longer than previous generations, yet we have a 50% chance of making it to 70 years old before we die or succumb to a critical illness such as cancer or cardiovascular disease

Read ArticleFinancial Possibilities Magazine

Healthy, Wealthy and Wiser about Retirement Risks

The various health-related foundations in Canada study the effects of critical illnesses closely. It is appropriate that we understand the risks associated with our health as we enter retirement. By understanding your health risks as you prepare for your retirement …

Read ArticleMortgages

Strategies for renewing your mortgage.

If you have a conventional mortgage at your bank, you normally get paperwork indicating it is about to renew when the term is ending. You may be offered quick renewable solutions to renew easily and stay with the current institution.

Read ArticleInvestor Insight

Reduction of the RRIF withdrawal

The Federal Budget 2015 has introduced a new withdrawal requirement for your Registered Retirement Income Fund (RRIF). Retirees are living longer into retirement. This necessitates a new mathematical model for withdrawing income over this extended period of time. It also allows …

Read ArticleInvestor Insight

Can a TFSA offer an emergency fund plan?

The Tax Free Saving Account (TFSA) can also provide Canadians with short-term protection as a vehicle in which they can build an emergency cash fund. Money can both accumulate and be withdrawn tax free. So if your transmission suddenly stops, or your water tank goes, or your income tax bill is higher than expected, a TFSA can provide funds necessary to cover these short term financial emergencies.

Read ArticleTax Tips Quarterly

Capital Gains Tax advantage of the TFSA

There are tax benefits to the Tax-Free Savings Account (TFSA) when assessing future taxation on capital gains on investments. RRSPs miss any capital gains taxation benefits. Equity funds earning capital gains in a non-registered account get a benefit of being only …

Read ArticleBudget Review

The TFSA update

You can open a Tax-Free Savings Account (TFSA) if you are 18 years of age or older and a Canadian resident. The Tax-Free Savings Account allows you to invest while not being taxed on interest or investment earnings. Here is …

Read ArticleTax Tips Quarterly

Tax Planning Year-Round

If you own a business, and your children and/or spouse work therein, consider paying them a reasonable salary from the business. If this is their only income, or they only work part-time elsewhere, they may not need to pay personal income tax if they earn below their personal tax exemption.

Read ArticleMortgages

A Mortgage Shoppers To-Do List

Prior to shopping for a new home, it is important to get a preapproved mortgage lined up several weeks in advance of closing. You also want to look at what mortgage brokerages are offering. Often you can find a competitive rate with excellent terms offered by an advisor who offers mortgages.

Read ArticleEstate View

Are TFSAs taxable in the estate?

The deceased estate will have to meet funeral expenses, probate charges, and fees, which are not deductible. The Canada Pension Plan pays a flat $2,500 death benefit to the estate, taxable in the hands of the beneficiary, usually the spouse or common law partner. Any unused sick leave is considered a “death benefit”, also taxable in the hands of the beneficiary.

Read ArticleFinancial Possibilities Magazine

Wealth Creation: Insights for Successful Investors

The following article will look at the wisdom of some of the top investors. All of them are billionaires. Wealth creation has a lot to do with a combination of wisdom and discipline plus learning from those who have advised …

Read ArticleInvestor Insight

TFSA and RRSP differences

What are some of the differences between a Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP)? First, let’s look at the recent changes which have occurred with regard to the TFSA: The TFSA has now been reverted back …

Read ArticleMortgages

What’s the difference between a fixed and variable rate mortgage?

It is easy to understand the difference of a fixed versus a variable mortgage.

Read ArticleMortgages

Mortgage planning hot points.

Know your mortgage facts. It is important to know the facts about your current mortgage and one that you may renew. Check out what your interest rate is, and your monthly payments are per month.

Read ArticleInvestor Insight

Tax Planning Scenarios Using the TFSA

There are basic uses for the Tax-Free Savings Account (TFSA) for investment planning purposes. The TFSA has now been reverted back to $5,500 from $10,000 contribution per year. Here are the facts: The new Liberal government announced that they would …

Read ArticleBusiness

Protecting your Business if Disabled

Disability Insurance provides a monthly income in the event you are incapacitated, and incapable of working due to an injury or illness. Often called “Income Replacement Insurance”, this coverage is important for self-employed individuals. It is also for those without disability insurance via their employer.

Read ArticleInvestor Insight

Registered Investments Plans in Canada

In Canada, the government has established registered plans that allow certain tax benefits for saving. Here are the three main plans

Read ArticleEstate View

TFSAs, RRSPs, Death and Taxes

There are certain tax benefits to the Tax-Free Savings Account (TFSA) when assessing future taxation. Let’s compare RRSPs and TFSAs. Bear in mind that there have been some changes affecting TFSA planning: The TFSA has now been reverted back to $5,500 from …

Read ArticleInvestor Insight

Quick RRSP Facts for the 2015 Tax Year

You can contribute to an RRSP if you earn income; up to $24,930 for the tax year of 2015, depending on your income, up to age 71 if you are a Canadian citizen.

Read ArticleEstate View

Critical Illness Insurance defined

Critical Illness Insurance is a plan contracted with a life insurer typically to make a lump sum cash payment if a policyholder is diagnosed with one of the critical illnesses listed in the insurance policy.

Read ArticleLife View

If you are taking a trip look at insuring your medical risk

These insurance plans can offer emergency medical protection for visitors, immigrants, foreign students and residents who are not covered by government health insurance. Visiting guests can be covered by valid medical health insurance which begins upon arrival here insofar as it is bought ahead of travel.

Read ArticleReal Estate

Understanding the basic Homeowner Mortgage

When a person is buying a home, new homeowner usually takes out a mortgage. A mortgage is a loan that taken out by a borrower who is referred to as the mortgagor. The property is used as security until the debt is repaid. The lending institution is referred to as the mortgagee.

Read ArticleInvestor Insight

Annuities can augment your retirement income for life

Annuities can offer the highest guaranteed income amount possible from an investment at the time of planning. They are an exceptional choice for an investor who wants to help cover essential expenses in retirement.

Read ArticleMortgages

What is the importance of a Status Certificate when buying a condo?

Condominium living has become an option for homeowners who want to reduce the many responsibilities associated with a single-family residence. Most condominium corporations assume these tasks and are a popular choice for both young and middle-age purchasers who are too busy, or prefer to limit their day-to-day home duties such as garbage and snow removal; home maintenance and repairs.

Read ArticleEstate View

Parents: Do not make this mistake in your will

Very few Canadians have a will, fewer have a currently updated will. Without a will, you cannot outline directives regarding your most “priceless asset” – your children. A will allows you to clarify your selection of a legal guardian for your children. Here are some steps to take in preparing for the transfer of parental responsibility while planning your will with your lawyer.

Read ArticleBusiness

How can I reduce business owner risks?

Start-up firms and smaller companies are especially vulnerable to potentially devastating financial risk because they often lack big company sophistication and in-house risk-control expertise. We will help you gain control of your financial risk.

Read ArticleLife View

Can life insurance offer my heirs tax-free capital?

Life insurance has provided families with basic financial security for well over 100 years. For example, a healthy, non-smoking 40-year-old male can purchase up to $500,000 worth of insurance for as little as $50 per month. That life insurance policy …

Read ArticleBusiness

3 ways Key-Person Insurance protects a business

If you are a business owner, you may have an individual who is key to your success. There is insurance to protect you against financial loss if he or she is incapacitated, in three areas.

Read ArticleBusiness

How can I empower the process of Business Succession?

Establish appropriate forums. Family retreats and regular meetings can allow the family to discuss the issues that will promote the continuation of a profitable family-run company.

Read ArticleFinancial Viewpoint

Creating your dream financial strategy

A good financial strategy is multi-faceted: It must anticipate change and reflect your specific financial goals and objectives while considering your level of investment risk tolerance. Your plan should be flexible enough to anticipate life’s many fluctuations. Financial circumstances and responsibilities …

Read ArticleBusiness

Social Media Tip: LinkedIn Marketing old style

Many business are using a LinkedIn connection to market to a potential prospect. However, there are certain limitations one should be aware of. What is the best way to find prospects who may have an interest in your product? How …

Read ArticleInvestor Insight

Reduce your debts and increase your financial security

Credit interest eats away at wealth Every household has a budget and must live within its means, as well as save for the future. We each must be careful to not allow debt interest repayment to reduce our ability to live comfortably, or retire with financial security.

Read ArticleMortgages

Can you benefit from the GST/HST New Housing Rebate?

HST Tax Rebate on New Homes in Canada The GST/HST New Housing Rebate is available to Canadian individuals who have bought a new home that is a primary residence or renovated a home significantly (small fix-ups don’t count). It also …

Read ArticleInvestor Insight

How can I get serious about investing?

There are four basic types of people, each with a distinct mindset when approaching investing: the Sideliner, the Gambler, the Hobbyist, and the True Investor. To become a serious and successful investor, you must consciously recognize and avoid the erroneous …

Read ArticleMortgages

Ready to buy?

Once you have found the home you would like to purchase, you need to present the vendor with an Offer to Purchase or an Agreement of Purchase and Sale. As your home is probably your biggest investment, it would be wise to work with your real estate agent and/or a lawyer/notary in preparing your offer.

Read ArticleInvestor Insight

The wealth of Canadian Families

A recent Statistic Canada study compares the wealth holdings of family units covered by workplace pension plans – 61% of the Canadian population – with those of other family units

Read ArticleMortgages

You can still buy a home with bad credit

The primary reason that lenders look carefully at your credit rating is that they don’t want you to get into a home that you can’t afford. This makes sense to everyone. No one likes to be living beyond their affordable …

Read ArticleTax Tips Quarterly

Tax Scams: Beware of CRA impersonations

Consumers and businesses need to protect themselves against fraudulent calls. The tax scams work because it is tax time again in Canada and fraudsters are taking the opportunity to scam people out of their money. Occasionally, taxpayers may receive, either …

Read ArticleLife View

Foreign Credit Card Transaction Fees

Many travel south in the winter to the US or abroad for many reasons. You may be planning to drive into the USA in the summer. You should be aware that most credit cards add a foreign transaction fee in …

Read ArticleLife View

Are you burning out?

If you think you are suffering from burnout, or would like to prevent it, here are some simple measures you can take.

Read Article